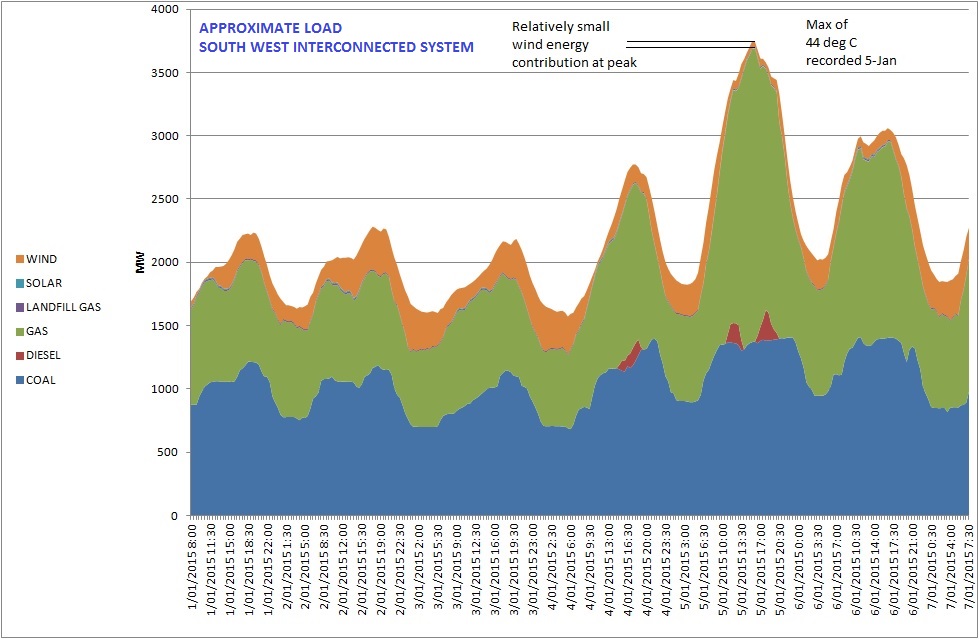

Sometimes the wind doesn't blow, and the sun doesn't shine.

Just a snapshot of the late morning in Perth today.

[graphic from RenewEconomy & Global-Roam Nem-Watch widget]

Just a snapshot of the late morning in Perth today.

[graphic from RenewEconomy & Global-Roam Nem-Watch widget]

RSS Feed

RSS Feed